Technological innovation and energy efficiency can reduce major sources of CO2 emissions from four sectors: power generation, transport, buildings and industrials. These "decarbonisation pathways" have the potential to reduce total emissions by 81% by 2050.

The highest-emitting industry1, responsible for roughly 26% of total GHGs

Solar, wind, and energy-storage solutions will propel decarbonisation

Emerging alternatives include green hydrogen and carbon capture

Given the high proportion of carbon created by power generation, expanding decarbonisation technologies in this sector can lead to significant change.

77% of fuel is made up of carbon-rich oil and its derivatives2

Electric vehicles are driving the industry's overall energy transition

Increased global regulations can reduce shipping and aviation emissions

With more alternatives to petrol power, and increasingly stringent regulations, the transportation sector is quickly evolving.

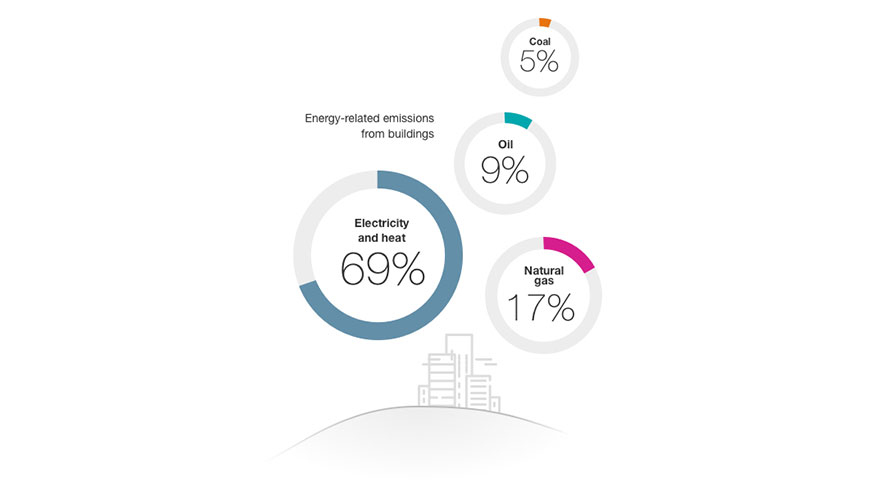

Account for 30% of global primary energy consumption3

More energy-efficient construction can lower this figure

Existing structures can be retrofitted with green technology

Fossil fuels heat and cool structures around the world. However, new technologies like hydrogen gas, as well as new building codes, will make a big difference.

Generate 21% of global emissions, including significant methane4

Energy efficiency has been a large focus in powering decarbonisation

Clean hydrogen may emerge as a key renewable solution

Mining, metal processing, and the production of gas and oil can be carbon intensive. Electrifying these industries could make them much cleaner.

Energy efficiency and renewable alternatives play critical roles in the drive towards net zero. And investments in specific technologies can speed up this effort. Investors should watch emerging developments aimed at lowering emissions, as they will be key to limiting global warming.

Begin your sustainable investing journey and discover other ways HSBC can support your wealth ambitions.

Important information

Investment involves risk. Past performance is not indicative of future performance. This document is for information only and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. The mention of any investment product or class of investment products ("product") should not be construed as representing a recommendation to buy or sell that product, nor does it represent a forecast on future performance of the product. The information contained on this web site is intended for Singapore residents only and should not be construed as a distribution, an offer to sell, or a solicitation to buy any securities in any jurisdiction where such activities would be unlawful under the laws of such jurisdiction, in particular the United States of America and Canada. The specific investment objectives, personal situation and particular needs of any person have not been taken in consideration. You should therefore not rely on it as investment advice. Before you make any investment decision, you may wish to consult a financial adviser. In the event that you choose not to seek advice from a financial adviser, you should carefully consider whether the investment product is suitable for you.

There is no guarantee that an investment approach which considers environmental, social and governance ("ESG") or impact investment factors will produce returns similar to those which don't consider these factors. Investments which consider ESG or impact investment factors may diverge from traditional benchmarks, returns and risk. Regulations about what constitutes ESG or impact investment are evolving. There is no standard definition of, or measurement criteria for ESG or impact investment. ESG and impact investment measurement criteria are subjective and may vary significantly across and within sectors.